Dealing with Bounced Checks in the Philippines:

Legal Consequences and How to Resolve Them

In the Philippines, a bounced check is more than just an inconvenience; it can lead to legal consequences that can significantly impact your life and liberty. Understanding the legal implications and how to resolve the issue is crucial to protecting yourself and your reputation. In this article, we will explore the legal consequences of bounced checks in the Philippines and provide practical advice on resolving them.

When a check bounces, there are insufficient funds in the issuer’s bank account to cover the payment. This can result in criminal charges and a damaged credit history. It’s important to know your rights and obligations as both the issuer and recipient of a bounced check and to follow the proper legal procedures to resolve the issue.

Whether you are dealing with a bounced check as a business owner or an individual, this article will provide valuable insights into the legal consequences of bounced checks in the Philippines and practical steps to resolve the situation effectively. Don’t let a bounced check derail your life and liberty– read on to learn how to protect yourself and resolve the issue.

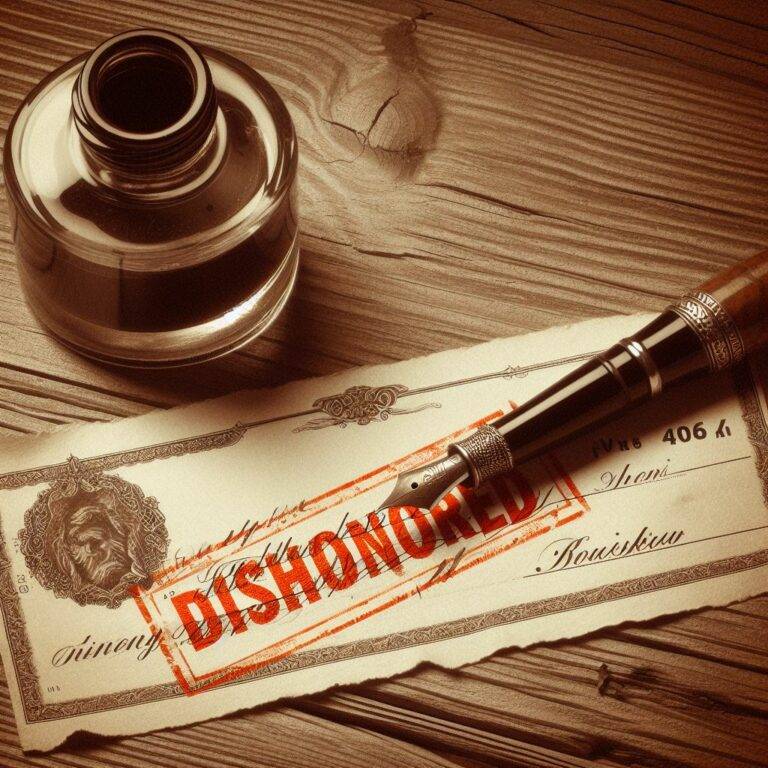

What is a bounced check or a dishonored check?

Bouncing a check in the Philippines is a serious offense that can result in criminal charges and legal consequences. Under the Philippine law, a bounced check or dishonored check violates the Bouncing Checks Law or Batas Pambansa Bilang 22 (BP 22). The law aims to deter the issuance of checks without sufficient funds and protect the integrity of commercial transactions.

Section 1 of Batas Pambansa Bilang 22 (BP 22) penalizes the issuance of a bouncing check as follows: Section 1. Checks without sufficient funds: “… shall be punished by imprisonment of not less than thirty days but not more than one (1) year or by a fine of not less than but not more than double the amount of the check which fine shall in no case exceed Two Hundred Thousand Pesos, or both such fine and imprisonment at the discretion of the court.”

Legal consequences of bouncing a check in the Philippines

A Deed of Sale is a document where the terms and conditions of a Contract of Sale is found. It is a legally binding document between a buyer and a seller that outlines the terms and conditions of the property purchase and transfer. This document serves as one of the proofs of the transfer of ownership from the seller to the buyer.

The Deed of Sale contains vital information such as the buyer and seller’s details, property description, purchase price, payment terms, and any additional terms and conditions agreed upon by both parties. It serves as evidence of the transaction and can be used to settle future disputes or claims related to the property.

In the Philippines, the Deed of Sale is typically prepared by the seller or their legal representative. However, both buyers and sellers must have a clear understanding of its contents to ensure a smooth and legally binding transaction.

How to avoid bouncing a check

Preventing a bounced check is always better than dealing with the legal consequences. Here are some practical steps you can take to avoid bouncing a check:

1. Maintain a sufficient balance in your bank account: Regularly monitor your account balance and ensure you have enough funds to cover the checks you issue. Keep track of your expenses and plan your finances accordingly.

2. Use alternative payment methods: If you are unsure about the availability of funds, consider using other payment methods such as cash, online banking transfers, or electronic payment platforms. These methods provide instant payment confirmation and eliminate the risk of a bounced check.

3. Communicate with your bank: If you anticipate any issues with your account balance, such as a pending deposit or a delayed payment, communicate with your bank in advance. They may be able to provide temporary solutions or advice to help you avoid bouncing a check.

Remember, prevention is key when it comes to bouncing a check. Taking proactive measures can minimize the risk of financial and legal consequences.

Steps to take when you receive a bounced check

If you are on the receiving end of a bounced check, it’s important to take the appropriate steps to resolve the issue. Here’s what you should do:

1. Notify the issuer: Contact the issuer of the bounced check immediately and inform them about the situation. Explain the consequences of bouncing a check and requesting immediate payment or a replacement check.

2. Document the incident: Keep records of all communication, including phone calls, emails, and text messages with the issuer. These records may be useful as evidence if legal action becomes necessary.

3. Send a demand letter: If the initial communication does not yield a satisfactory response, send a formal demand letter to the issuer. The demand letter should clearly state the amount owed, the reason for the payment, and a deadline for the payment to be made. Keep a copy of the demand letter for your records.

Filing a criminal complaint for a bounced check

If negotiation fails or the issuer refuses to cooperate, you may need to escalate the matter by filing a criminal complaint for a bounced check. This is governed by Batas Pambansa Bldg. 22 (BP 22). BP 22 provides protection for individuals and businesses who have been victims of bounced checks. Here are the steps involved in filing a criminal complaint:

1. Consult a lawyer: It is important to talk to a lawyer or law firm, about BP 22 cases because they know how to navigate the complicated Batas Pambansa Bilang 22 system, come up with a strong defense strategy that is unique to the case, make sure that all the rules are followed and deadlines are met, use their negotiation skills to find possible settlements or plea deals, represent their clients in court to get the best outcome, and explain possible punishments and work to lessen their effects.

2. Gather evidence: Before filing a criminal complaint, ensure that you have sufficient evidence to support your case. This includes the bounced check itself, any communication with the issuer regarding the bounced check, and any other relevant documents. Keep copies of all correspondence and receipts as evidence.

3. File a complaint with the appropriate authorities: Once prepared, it is time to file the complaint before the appropriate authorities. Provide all the necessary details and submit the required documents. The appropriate authorities will review your complaint and decide whether to pursue criminal charges.

4. Attend hearings and cooperate with the authorities: If the deciding body decides to pursue criminal charges, you will be required to attend hearings and cooperate with the authorities. Provide any additional evidence or information requested. Being prepared and presenting your case effectively during these proceedings is important.

Filing a criminal complaint for a bounced check is a serious matter, and the legal process can be complex and time-consuming. It’s advisable to seek legal advice before proceeding to ensure that you understand your rights and obligations.

Conclusion

Dealing with bounced checks in the Philippines requires a thorough understanding of the legal consequences and the appropriate measures to resolve the issue. Whether through negotiation, criminal complaints, civil remedies, or the assistance of bounced check collection agencies, it’s crucial to take prompt and decisive action to protect your financial interests.

By being aware of your rights and obligations, gathering sufficient evidence, and seeking professional advice when necessary, you can navigate the complexities of bounced check cases with confidence. Remember, a bounced check is not the end of the world – it’s an obstacle that can be overcome with the right approach and determination. Stay informed, be proactive, and safeguard your financial future.

How Ricasio Law can assist you?

Ricasio Law is a law firm in the Philippines and an expert in Criminal Law. Our team of Criminal Lawyer experts can give you useful advice and help you figure out the best thing to do. Get in touch with us right away to talk about your case and let us help you prepare and review a Deed of Sale.

Disclaimer: The content on this website is offered as general information only and is not intended to be legal advice or a solicitation for legal services. The information is not being supplied as part of an attorney-client relationship between the Lawyers of Ricasio Law and anyone viewing it. Viewers should not rely on the information on this website for making legal decisions, but should instead get legal assistance from a skilled attorney. You should not act exclusively on the basis of the material on this website and are strongly recommended to seek the legal advice of a lawyer.

If you are interested in the legal representation, counseling, and other legal services that we offer, please contact us using the information provided on this website. You can also discover more about our real estate transaction services here.

Contact Us

+63 (906) 590 0259

Unit 202, Cristina Condominium, Legaspi Street cor. V.A. Rufino Street, Legaspi Village, Makati City

OFFICE HOURS

MON-FRI 9:00 AM – 12:00 PM | 1:00 PM – 5:00 PM (GMT +8)

SAT 10:00 AM – 2:00 PM (GMT +8) by appointment